Making money is not easy, which is why you need to save as much as you can. Whether it’s by skipping a meal or putting off a trip, every dollar counts.

Saving is not just about making sacrifices; you have to be intentional with your spending. Experts call this frugal living. And it all starts with knowing tools that streamline your budget.

Certain apps keep tabs on your accounts and advice on where to cut costs. You can also earn interest on the little you have by lending through peer-to-peer platforms.

As the saying goes, if you fail to plan, you are planning to fail. A budget is your best ally when planning on money-management.

And just to be clear, saving need not strain your life. For example, you can go for meal subscription plans for good but cheap food.

When it comes to using coupons, be consistent to ensure tangible savings. Registering on apps such as Ibotta will see you save up to $150 every year.

Do you keep store receipts? You could be sitting on hundreds of dollars in rewards. There are apps, that pay you for completed purchases.

Reward apps will save you money on a wide range of items including;

- Gas Stations

- Pet Stores

- Hardware Stores

- Eateries

Apart from rewards, consider buying from establishments that give cashbacks. You get to redeem a percentage of your spending for either cash or gift cards.

I consider cashback to be earnings for doing nothing. Such opportunities range from making a reservation to claiming cash back on online shopping.

Ever experienced the excitement that comes with an unexpected cash refund? Well, with the right tools, you can start checking for refunds constantly.

Use platforms to track your online shopping and notify you of price drops and help you claim your dues.

So, what strategy are you employing to save money? Read on for tried and tested saving opportunities today.

Did you know that you can earn while reading a newspaper at your home through Daily Mail Rewards? Yes, you can get paid for reading the news and all that is required is for you to become a member of the Daily Mail Rewards Club. It’s a loyalty plan that rewards you with points every …

Read More about Daily Mail Rewards Login Process 2024 (My Mail Rewards)

Costco Executive membership hours may have been one of the perks that have drawn many people to Costco’s top membership tier but that provision no longer exists and all Costco members now enjoy the same hours of operation. Nevertheless, there are many Costco Executive membership perks that may benefit you in several ways. Costco boasts …

Read More about Costco Executive Membership Hours [Perks & Privileges 2024]

Below is a TopCashback review in full detail. Cashback sites are all about helping users save money from their daily shopping. Retailers and manufacturers pay commissions to the sites to showcase their wares to you. In return, the sites share a percentage of the commissions with you when you make a purchase. There are many …

Read More about Topcashback Review 2024: Is TopCashback Worth It? [Read Now!]

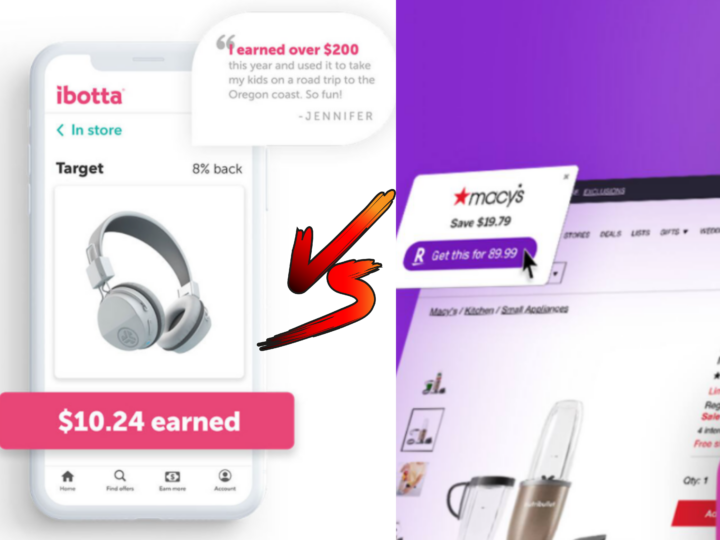

If you’re looking to earn via cashback apps or websites, then you might have come across Ibotta vs Rakuten comparisons. These are arguably the top get-paid-to platforms for free money from normal online activities. Whether you are just browsing the net or buying stuff, these sites notify you of opportunities to save money. Depending on …

Read More about Ibotta vs Rakuten – What’s a Better Cashback App?

It’s no secret that budgeting can be overwhelming, which is why you need the best budgeting planner as part of your financial tools. Every decision that involves money, requires budgeting. This does not, however, mean that you limit yourself on things you want but rather, budgeting ensures that you understand your financial limitations. Planning also …

Read More about 29 Best Budget Planner Books You’ll Ever Want [2024]

Rnairni’s bundle is perfect for people looking to dive headfirst into budgeting. It comes with a cash envelope wallet in addition to a mini-budget planner book and organizer. The wallet comes with a wrist strap, marker, binder clip, 12 printed cash envelopes, 12 budget sheets, a summary of the year sheet and quick start …

Read More about 15 Best Cash Envelope System Wallets To Shop In 2024